As pay-per-click (PPC) advertisers, we often find ourselves being approached by clients who want to know what their competition is doing. Are they bidding on the same keywords as us? Are they bidding on other keywords we aren’t? What are they saying in their ad copy? How much are they spending on clicks?

To quote Sun Tzu, one of the most influential military strategists of all time, “Know thy self, know thy enemy. A thousand battles, a thousand victories.”

While that same logic might still be applicable to today’s world, the actual applications are different. Sure, it might seem like a good idea to roll up to your competitors’ headquarters with an army, but due to the incredible advancements in technology since Sun Tzu’s time, there are subtler and perhaps less taxing ways to take on the competition.

Competitive Spying Tools

In the case of search engine marketing, one of those ways is through the use of competitive spy tools. These tools not only give you an idea of who is in your competitive landscape but also attempt to peel back the curtain into your competitors’ marketing strategy meetings. PPC competitive spying tools give you an estimate of what keywords your competitors are bidding on, how much traffic they are driving to their website, and what they are saying in their ad copy. At face value, it seems like these competitive spying tools would be incredibly powerful tools to have at your disposal. But how accurate are these estimates really?

We decided to put these tools to the test in this three-part blog post to find out, matching up one of our very own (anonymous) accounts with the estimates found on two of the more popular PPC competitor spying tools, SpyFu and Semrush. (For the purposes of this blog, we are just focusing on the PPC aspect, but SpyFu and Semrush do offer more than just the PPC data discussed below.)

SpyFu

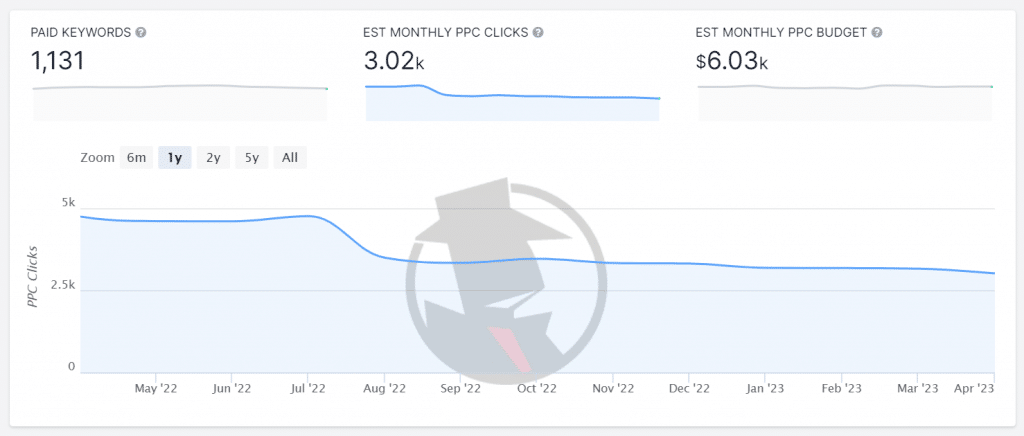

When using the competitive analysis tool, SpyFu, it estimates that our anonymous account gets roughly 3,000 clicks a month with an advertising budget of roughly $6,000 a month. This is illustrated in the “Monthly PPC Overview” table below.

Semrush

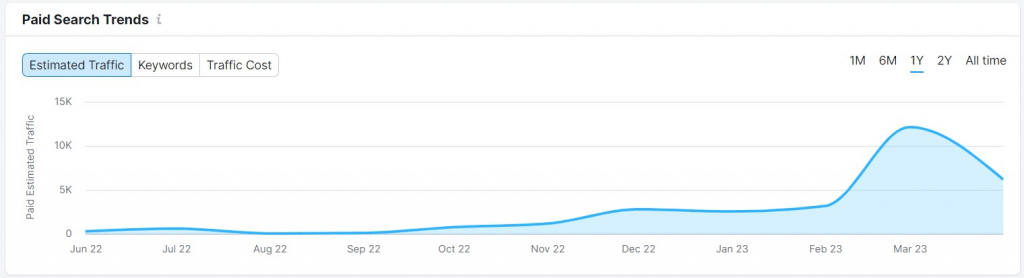

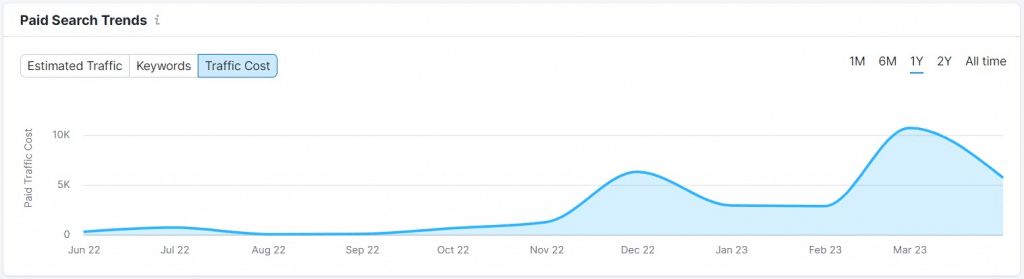

The PPC competitive spy tool, Semrush, is very confusing. We can’t get a definition of what “Estimated Traffic” is. Is it possible impressions that the account could have gotten, or is it the estimated clicks that the account could have received? We can’t find a definition for it on the Semrush website, and not even ChatGPT could answer the question! If we think Estimated Traffic is clicks, Semrush estimates our anonymous account averages about 4,700 clicks a month, with an average monthly budget of $5,000. You can see this illustrated in the two tables below:

Our Anonymous Account

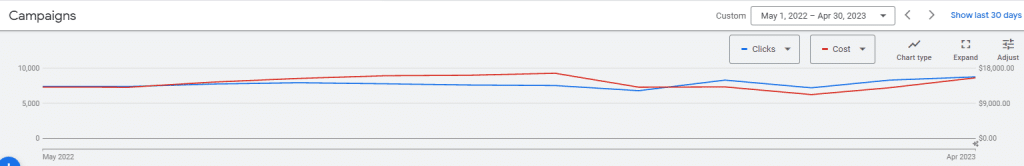

Here are the actual results from our anonymous account from Google Ads (see note below).

First, look at how different the graphs are between the two tools (SpyFu and Semrush). SpyFu shows more clicks last year and tapers off, while Semrush shows the opposite. In comparison, our actual account showed very little variance at all.

Now, comparing those numbers to the actual data compiled over the last 12 full months, there appears to be a large discrepancy. It’s hard to get a straight answer on whether SpyFu and Semrush factor in Microsoft ads (I found conflicting information on both SpyFu and Semrush’s websites – it appears they do for SEO, but PPC is much murkier). So, in the spirit of fairness, let’s look at the monthly averages that our anonymous account spent on Google Ads Search ads alone. In Google Ads, we averaged about 7,500 clicks a month from Search ads (non-shopping, non-display, etc) with an average monthly budget of $13,800. So, even when we are looking at only Google Ads Search data, SpyFu and Semrush estimations were both off by more than two times.

First off, we have underestimated results. SpyFu claims that when the estimates are off, they tend to be off for the entire industry. So, in theory, you can use the actual data from an account you have knowledge of and the estimates provided by SpyFu to create a baseline, and then you could use that same baseline ratio and apply it to the competitors in that field. For example, if we know that our anonymous account is actually spending about two times as much as SpyFu states, we can then look at the competition and apply that same two times to the data we see. But that seems a too convenient answer (after all, how do you prove it?). Also, what about the discrepancy for Semrush?

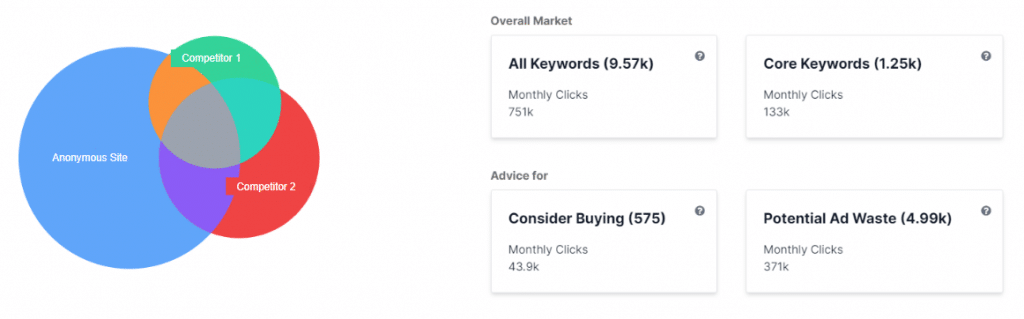

SpyFu also offers some competitor keyword information via the Venn diagram on their “Kombat” tab, illustrated below.

The Venn diagram is made up of your site’s keywords, the keywords of your two biggest competitors (according to SpyFu), and where each site’s keywords overlap with one another. Keywords are broken into four categories: All Keywords, Core Keywords, Consider Buying, and Potential Ad Waste. Ignoring the first category, the other three categories I found to be quite intriguing.

- Core Keywords is the absolute middle of the Venn diagram and consists of keywords that all three sites are advertising on.

- Consider Buying consists of keywords that your two competitors are advertising on, but you yourself aren’t. So, SpyFu is offering you some additional keywords you may be missing out on.

- Potential Ad Waste is the keywords you are advertising on, but your two competitors are not. Looking at this list of keywords that SpyFu gives as a waste for our anonymous account, the top keyword is a keyword that is not even in our account, nor has it ever been. It also includes a lot of branded keywords, which would make sense that competitors aren’t advertising on, and we absolutely should.

Given some of the suggested waste not even being in the account, I question the relevancy and the legitimacy of the information provided. And while the Consider Buying portion could be helpful, Google Ads is never shy in giving you new keyword recommendations. And I feel it’s a good time to once again note that the tools found in Google Ads are free and have actual access to data, whereas tools like SpyFu and Semrush are third-party tools.

Google Ads Auction Insights Tool

Based on these results, my first thought is how much more useful are these PPC competitive spy tools compared to the free tools found in Google Ads itself? With the Auction Insights tool, you can see who your competitors are and how you match up to them. It’ll show you which competitors are outranking you, and how much of the impression share you have versus the competition. And since Auction Insights is not a third-party tool, it has actual access to the data!

All this to say, no, it doesn’t appear that these PPC competitive spying tools are all that more helpful than the tools provided within the Google Ads interface. One could even make the argument that it may hurt your PPC advertising strategy. With such a large discrepancy in the data, it could give you a false sense of reality, and if you were to then make judgments based on that false reality, it could lead to a more inefficient overall PPC marketing strategy.